lada-56.ru

Learn

Is Penny Stocks Worth Buying

Watch for misstatements about your net worth, income and account objectives as well. Investing in penny stocks is speculative business and involves a high. 1)The risk is obviously higher on Penny stock as it is new. 2) Once you buy a penny stock, you will have less control over it as operators play. Penny stocks usually have bad fundamentals, only the low price doesn't make it a penny stock. Also only a few make it in the market. Penny stocks are common shares of small public companies that trade for less than one dollar per share. The U.S. Securities and Exchange Commission (SEC). Penny stocks are typically issued by small companies and cost less than $5 per share. They can garner interest from some investors who want to get in close. It's never a good idea to ask yourself if you can get rich by trading or investing in any particular asset class, including penny stocks. While it's certainly. Penny stocks are typically issued by small companies and cost less than $5 per share. They can garner interest from some investors who want to get in close. But the truth is, the high volatility and low liquidity of penny stocks makes investing in them high risk. buy stocks before deciding whether or not investing. Best penny stocks · iQIYI Inc. (IQ) · Geron Corp. (GERN) · lada-56.ru (TBLA) · Archer Aviation Inc. (ACHR) · Navitas Semiconductor Corp. (NVTS) · Nuvation Bio Inc.. Watch for misstatements about your net worth, income and account objectives as well. Investing in penny stocks is speculative business and involves a high. 1)The risk is obviously higher on Penny stock as it is new. 2) Once you buy a penny stock, you will have less control over it as operators play. Penny stocks usually have bad fundamentals, only the low price doesn't make it a penny stock. Also only a few make it in the market. Penny stocks are common shares of small public companies that trade for less than one dollar per share. The U.S. Securities and Exchange Commission (SEC). Penny stocks are typically issued by small companies and cost less than $5 per share. They can garner interest from some investors who want to get in close. It's never a good idea to ask yourself if you can get rich by trading or investing in any particular asset class, including penny stocks. While it's certainly. Penny stocks are typically issued by small companies and cost less than $5 per share. They can garner interest from some investors who want to get in close. But the truth is, the high volatility and low liquidity of penny stocks makes investing in them high risk. buy stocks before deciding whether or not investing. Best penny stocks · iQIYI Inc. (IQ) · Geron Corp. (GERN) · lada-56.ru (TBLA) · Archer Aviation Inc. (ACHR) · Navitas Semiconductor Corp. (NVTS) · Nuvation Bio Inc..

Penny stocks can be profitable for investors, but they are also risky. They are not frequently traded stocks and often sudden bouts of market volatility. However, high volatility and frequent fraud can make investing in penny stocks and similar speculative securities very risky. Understanding some key. Penny stocks are low-value shares that often trade over-the-counter as they do not meet the minimum listing requirements of exchanges. · Penny stocks can be far. Penny stocks come with high risks and the potential for above-average returns, and investing in them requires care and caution. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. Yes, penny stocks are worth the risk provided that you're willing to put in the time and actually do some due diligence on the company you're. As penny stocks are generally worth less than 5 dollars per stock, they can offer investors a more affordable pathway into the stock market. Penny stocks. The Risks of Investing in Penny Stocks. It's impossible to entirely avoid risk when trading penny stocks. You will make mistakes and lose money at some point. Opportunity for Early Investment: Penny stocks often belong to small or emerging companies that are in the early stages of their growth. Investing in these. Penny stocks are often extremely high risk but can potentially offer extremely high rewards, so buyers need to perform their due diligence. Fortunately. Penny Stock Screener ; LFCR. Lifecore Biomedical. $ $ (%) ; ORGN. Origin Materials. $ $ (%) ; GOEV. Canoo. $ $ (%). Penny stocks – those that trade for low prices, often less than a dollar per share – are dangerous. Period. The insider purchase of LESL stock can be considered a bullish signal, as it demonstrates increased confidence in the company's future. It could also indicate. Let's discuss 11 penny stocks where you can get profitable positions for the rest of this year, barring unforeseen events. Penny stocks are generally stocks that trade at less than five dollars a share. This relatively low price per share can make them attractive to many investors. Investing in penny stocks can be exciting. With a wide range of industry options, higher volatility and hundreds of stocks under $20, it's easy to see why so. Anyone can buy and sell penny stocks, though it is recommended that they have the appropriate risk tolerance before investing in these speculative securities. stocks - meaning the brokers who commit to buying and selling those OTC securities. worth or income standards. In addition, Regulation D exempts some. Investing in penny stocks can be worth it if the investor fully understands the risk that these securities carry. The investor should only use money that they. How to trade penny stocks · Open a live trading account. · Fund your account. · Research to find the right stocks for you. · Decide if you want to buy or sell.

How Much Does Re Plumbing A House Cost

If you are looking into replacing your home's plumbing pipes, you will typically spend between $2, and $15, for PEX piping OR between $2, and. Typically, plumbers are subject to an hourly rate, which is often between $45 and $ Common repairs attract an average rate of $ Most homeowners spend $2, to $5, to install new plumbing in their house. Replacing a bathtub, sink, or toilet will cost between $ and. The average cost per square foot of commercial plumbing is $ However, in the commercial space, this number is almost always closer to $6. This guide will help you decipher why repiping a house costs an average of $7, but can run anywhere between $1, and $15, It'll also help you narrow. Replacing small sections of pipe at a time will cost between $ and $2,–with the average cost being $1, Repiping an entire home or installing new. On average, homeowners can expect to spend between $1, to $4, to re-pipe a typical single-family home. It's essential to obtain quotes. This is a big job, so plan to spend around $4, to $6, for a major sewer repair. Less Common Repair Costs. The following plumbing repair items are less. The National Average Cost to repipe a house is around $4, The minimum cost of repiping a home is $1, for a smaller house with fewer pipes. The maximum. If you are looking into replacing your home's plumbing pipes, you will typically spend between $2, and $15, for PEX piping OR between $2, and. Typically, plumbers are subject to an hourly rate, which is often between $45 and $ Common repairs attract an average rate of $ Most homeowners spend $2, to $5, to install new plumbing in their house. Replacing a bathtub, sink, or toilet will cost between $ and. The average cost per square foot of commercial plumbing is $ However, in the commercial space, this number is almost always closer to $6. This guide will help you decipher why repiping a house costs an average of $7, but can run anywhere between $1, and $15, It'll also help you narrow. Replacing small sections of pipe at a time will cost between $ and $2,–with the average cost being $1, Repiping an entire home or installing new. On average, homeowners can expect to spend between $1, to $4, to re-pipe a typical single-family home. It's essential to obtain quotes. This is a big job, so plan to spend around $4, to $6, for a major sewer repair. Less Common Repair Costs. The following plumbing repair items are less. The National Average Cost to repipe a house is around $4, The minimum cost of repiping a home is $1, for a smaller house with fewer pipes. The maximum.

Average Cost of Replumbing or Repiping a House · Average: $1, · Range: $ – $1, · Low: $ · High: $4, Cost of Plumbing a House Per. If your plumbing is in poor condition and the whole system needs repiping, the total costs will vary depending on your property's size. The UK average repiping. plumber's billable rates can range from $$hr and higher and repiping is 90% labor and they do not patch their work and that is added cost. Most homeowners spend $2, to $5, to install new plumbing in their house. Replacing a bathtub, sink, or toilet will cost between $ and. According to data from our Reliant Plumbers, an average home repipe can cost anywhere between $6, and $35, for our service areas, but our clients can. According to data from our Reliant Plumbers, an average home repipe can cost anywhere between $6, and $35, for our service areas, but our clients can. To install plumbing pipes in a newly constructed home, the national average cost is $ per square foot. For a typical, 2,square-foot house with 2 full. But is a plumbing disaster imminent or just a concern for the distant future? Replacing old pipes in a 1,square-foot, two-bathroom home costs $4, to. The average cost to repipe a house is between $ to $ per foot for the pipe. When you include your hours and any additional costs, a 1, sq foot house. Plumbing Cost Estimator. The cost of a plumber ranges from $ to $ for a typical job with the average cost per hour ranging from $45 to $ For example, Pete Rodriguez of Atlantic Re-Plumbing[2] says a /2-bathroom house that costs $3, to re-plumb with CPVC would start at $4, in copper, and. While the majority of repiping jobs fall between $ and $ on average when installing PEX pipes. $ to can be the cost. Average Cost of Replumbing or Repiping a House · Average: $1, · Range: $ – $1, · Low: $ · High: $4, Cost of Plumbing a House Per. No matter what type of pipe you're replacing, the cost is impacted by the material you choose for your new pipes. While we often recommend PEX pipes for homes. The national average cost for plumbing system installation is approximately $4,, with most projects falling within the range of $2, to $5, Financing. replacing hard copper or pex pipes that are leaking or have corroded over time. This process is also commonly referred to as re plumbing a house. You pay a. As our numbers show in average cost that homeowners paid for plumbing pipe installation in King county is between $ and $6, This House. Cost does not include re-locating plumbing, carpentry repairs, major Manhours for replumbing a house are included in price. Cost estimate includes. The average cost to replumb a house. The low-end cost, $2, The average cost, $4, The average cost range, $3, - $5, ; The cost of replumbing a house. How Much Do PEX Plumbing Pipes Cost? · Re-piping a house usually requires a permit from the local planning or building department; fees vary, but typically cost.

What Are Digital Coins

Digital money, or digital currency, is any form of money or payment that exists only in electronic form. It lacks a tangible form, such as a bill, check. Click here to explore the dashboard on central bank digital currency Tech Champion: Stefano Leucci Central Bank Digital Currency (CBDC) is a new form of. Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the. The Digital Currency Initiative is a research community at the MIT Media Lab focused on cryptocurrency and blockchain technology. · We support open source core. 20 of the Most Popular Cryptocurrencies to Watch This Year · 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. Tether (USDT) · 4. USD Coin (USDC) · 5. BNB (BNB) · 6. The digital euro is an electronic form of public money – the coins and notes in our wallets. We refer to it as central bank digital currency, or CBDC. Cryptocurrencies are digital tokens. They are a type of digital currency that allows people to make payments directly to each other through an online system. The public sector can issue digital money called central bank digital currency—essentially a digital version of cash that can be stored and transferred using an. Digital currencies such as Bitcoin, how they work, risks, warnings, protecting yourself and tax implications. Digital money, or digital currency, is any form of money or payment that exists only in electronic form. It lacks a tangible form, such as a bill, check. Click here to explore the dashboard on central bank digital currency Tech Champion: Stefano Leucci Central Bank Digital Currency (CBDC) is a new form of. Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the. The Digital Currency Initiative is a research community at the MIT Media Lab focused on cryptocurrency and blockchain technology. · We support open source core. 20 of the Most Popular Cryptocurrencies to Watch This Year · 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. Tether (USDT) · 4. USD Coin (USDC) · 5. BNB (BNB) · 6. The digital euro is an electronic form of public money – the coins and notes in our wallets. We refer to it as central bank digital currency, or CBDC. Cryptocurrencies are digital tokens. They are a type of digital currency that allows people to make payments directly to each other through an online system. The public sector can issue digital money called central bank digital currency—essentially a digital version of cash that can be stored and transferred using an. Digital currencies such as Bitcoin, how they work, risks, warnings, protecting yourself and tax implications.

As a digital euro would be backed by a central bank, it would not be a crypto-asset. Central banks have a mandate to maintain the value of money, whether it is. Cryptocurrency is currency in digital form that is not overseen by a central authority. The first cryptocurrency was Bitcoin, created by an anonymous. Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments (also known as. To conduct virtual currency business activity in New York State, entities can either apply for a BitLicense or for a charter under the New York Banking Law (for. Cryptocurrency is a digital currency using cryptography to secure transactions. Learn about buying cryptocurrency and cryptocurrency scams to look out for. The story of digital currencies is a continuation of the long-running saga of economics, markets, and commodity exchange in human society. Despite their claim of being the money of the future, current private digital currencies, like bitcoin, don't work well for making payments or saving for the. This downloadable brochure is a quick guide to virtual currencies that covers how virtual currencies can be purchased, why they are considered commodities, and. Cryptocurrencies (“crypto”) are digital assets that rely on an encrypted network to execute, verify, and record transactions, independent of a government or. Digital currency is money in an electronic form exchanged for goods and services without the use of physical money such as paper bills or coins. Simply put, a Digital Canadian Dollar would be a digital form of the cash in your wallet. Like cash, it could buy the things you need. But the advantage is that. Digital money is the digital representation of value. The public sector can issue digital money called central bank digital currency—essentially a digital. Cryptocurrency is a type of currency that uses digital files as money. That seems easy enough, right? It's decentralized, which means no one person or entity. A Digital Canadian Dollar would be a digital form of the cash in your wallet. Like cash, it could buy the things you need. So called for their use of cryptography principles to mint virtual coins, cryptocurrencies are typically exchanged on decentralized computer networks between. Cryptocurrency trading involves speculating on price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Here you'. Bitcoin is a cryptocurrency, which is to say a type of digital currency. Unlike traditional currencies - the dollar or pound, for example - Bitcoin is not. Virtual currency is treated as property and general tax principles applicable to property transactions apply to transactions using virtual currency. Virtual currency is a type of unregulated digital currency. It is not issued or controlled by a central bank. Examples of virtual currencies include.

House Foundation Problem

Learn more about foundation issues, how to spot them, how to fix them, and how to know when it makes sense to sell your house as-is. How to Identify Common Signs of Foundation Problems in Buildings · Visible Cracks in Walls and Floors · Uneven or Sloping Floors · Doors and Windows Misalignment. Visible gaps at the junctions of walls with ceilings or floors are strong indicators of foundation issues. Such separation typically occurs when the home's. Whatever the value of the house would otherwise be, the cost of the foundation repair will have to be deducted from it. Then subtract a little more as an. Warning Signs of Foundation Damage · 1. Drywall Cracks or Floor Cracks · 2. Sticking Doors and Windows · 3. Floor and Wall Gaps · 4. Sagging or Uneven Floors. Repair the walls from the inside with wood or steel braces, carbon-fiber mesh, or wall anchors spaced 6 feet or so apart along the entire wall. For about $ One of the most visible signs of foundation issues is the presence of cracks in the walls and floors of a home. While small, hairline cracks might be a natural. These problems may manifest as cracks in walls, uneven floors or misaligned doors and windows. Distinguishing between the two is vital because foundation. A bulge or curve in either a block foundation or a poured concrete wall could signal that the foundation has shifted, or that the soil around your foundation. Learn more about foundation issues, how to spot them, how to fix them, and how to know when it makes sense to sell your house as-is. How to Identify Common Signs of Foundation Problems in Buildings · Visible Cracks in Walls and Floors · Uneven or Sloping Floors · Doors and Windows Misalignment. Visible gaps at the junctions of walls with ceilings or floors are strong indicators of foundation issues. Such separation typically occurs when the home's. Whatever the value of the house would otherwise be, the cost of the foundation repair will have to be deducted from it. Then subtract a little more as an. Warning Signs of Foundation Damage · 1. Drywall Cracks or Floor Cracks · 2. Sticking Doors and Windows · 3. Floor and Wall Gaps · 4. Sagging or Uneven Floors. Repair the walls from the inside with wood or steel braces, carbon-fiber mesh, or wall anchors spaced 6 feet or so apart along the entire wall. For about $ One of the most visible signs of foundation issues is the presence of cracks in the walls and floors of a home. While small, hairline cracks might be a natural. These problems may manifest as cracks in walls, uneven floors or misaligned doors and windows. Distinguishing between the two is vital because foundation. A bulge or curve in either a block foundation or a poured concrete wall could signal that the foundation has shifted, or that the soil around your foundation.

Whatever the value of the house would otherwise be, the cost of the foundation repair will have to be deducted from it. Then subtract a little more as an. It's important to remember that foundation repair does not directly increase the value of your home. However, it does restore the value of your home, allowing. However, in older homes, cracked brick may indicate a foundation issue. While fractures can indicate trouble, don't assume your foundation is damaged. It's. I own two homes with foundation issues - the first was caused by improper drainage and it created hurricane Katrina levels of mold in the home. I bought a house in Dallas in late and after 6 months of buying I have started noticing cracks on the walls and tiles. One of the most obvious signs of foundation issues are the cracks, gaps, and fractures that appear in the home's foundation and in other parts of the house. #1) Wall Cracks and Fractures · #2) Foundation Settling or Sinking · #3) Foundation Upheaval · #4) Noticeable Interior Separation. There are many tell-tale signs of foundation issues ranging from simple cracking to complete separation. Identifying Common Foundation Problems: · Cracks in mortar or bricks · Soil Pulled Away From Exterior Walls · Damage On Southeast & Southwest Corners · Trim Pulled. Houses built on hillsides can fall victim to soil creep which causes the house to settle or slide. Soil creep not only leads to foundation damage but it can. Signs of Foundation Problems · 1. Doors Stick or Don't Latch · 2. Large Cracks on Foundation Walls · 3. Cracking on Interior Walls · 4. Cracks in Floor Tiles or. Problems can also include floor cracks, wall fissures, and a cracked chimney. Foundation movement can happen over time due to many conditions. Your foundation. Perhaps the most easily visible of the signs that your foundation may have problems is when your wall moves away from your house. It occurs mainly due to a. Perhaps the most easily visible of the signs that your foundation may have problems is when your wall moves away from your house. It occurs mainly due to a. Foundation issues can cause devastating structural problems throughout a house, making it imperative to repair them as soon as possible. Although it can be. Foundation problems often are caused by factors that shift the soil under your home. Soil conditions under and around your house directly affect the building's. Sheetrock cracks over doors – one of the first warning signs that a house has foundation and leveling problems is stress cracks appearing in the sheetrock of. When your foundation is beginning to fail, doors that used to function properly begin to give you problems. As the foundation shifts, the house begins to settle. CRACKS · Floor. A sinking or heaving foundation will put pressure on floor materials and can cause cracks or breakage in tile, wood floors and concrete. CRACKS · Floor. A sinking or heaving foundation will put pressure on floor materials and can cause cracks or breakage in tile, wood floors and concrete.

Buying Gold With 401k

This process, known as a (k) to Gold IRA rollover, allows individuals to take advantage of the benefits of precious metal investments. U.S. Money Reserve is the only gold company led by a former U.S. Mint Director. Buy precious metals bullion, bars, and coins with confidence. The vast majority of (k) plans do not allow individuals to directly invest in gold, such as purchasing gold bullion or gold coins. However. Can I buy physical gold for my Individual Retirement Account (IRA) or (k)?. The fund will invest in or hold investment units of the SPDR Gold Trust Funds listed on the Singapore Stock Exchange in US dollars currency for the average in. There are several ways to buy gold, including direct purchase, investing in companies that mine and produce the precious metal, and investing in gold exchange-. While investors can begin a Gold IRA with as little as $, American Bullion recommends a minimum rollover amount of $10, to account for any fees. Gold ETFs: If your (k) includes brokerage options, you can buy gold ETFs. These funds hold physical gold and sell shares, giving you a direct link to. The direct purchase of precious metals and other collectibles in an IRA or other retirement plan account can result in a taxable distribution from that account. This process, known as a (k) to Gold IRA rollover, allows individuals to take advantage of the benefits of precious metal investments. U.S. Money Reserve is the only gold company led by a former U.S. Mint Director. Buy precious metals bullion, bars, and coins with confidence. The vast majority of (k) plans do not allow individuals to directly invest in gold, such as purchasing gold bullion or gold coins. However. Can I buy physical gold for my Individual Retirement Account (IRA) or (k)?. The fund will invest in or hold investment units of the SPDR Gold Trust Funds listed on the Singapore Stock Exchange in US dollars currency for the average in. There are several ways to buy gold, including direct purchase, investing in companies that mine and produce the precious metal, and investing in gold exchange-. While investors can begin a Gold IRA with as little as $, American Bullion recommends a minimum rollover amount of $10, to account for any fees. Gold ETFs: If your (k) includes brokerage options, you can buy gold ETFs. These funds hold physical gold and sell shares, giving you a direct link to. The direct purchase of precious metals and other collectibles in an IRA or other retirement plan account can result in a taxable distribution from that account.

Now, while (k) plans allow solid growth of retirement savings, a gold IRA allows individuals the chance to diversify their portfolio by investing in precious. You can buy gold coins and bullion in a self-directed IRA or (k) established with a trust company: Goldbroker offers precious metal IRAs. Dealers use the “gold IRA” label for SDIRAs when they want older workers or retirees to use their retirement savings to buy gold or silver bullion. Money can be. There are some drawbacks: Some gold funds are taxed as collectibles, so they don't benefit from the lower long-term capital-gains rates for which stocks may. Your best option for moving active (k) money into Gold is to take a loan against the account. Refer to the (k) loan to buy Gold section below. You can still gain exposure to the gold, silver, or platinum markets in your (k) plan by individually selecting stocks in gold mining companies. Once the funds are in the IRA, you can then purchase gold. When it comes to actually buying gold, you have several options. You can choose to. He's decided that he wants to take out 2/3 of what is in his k, ~$k, and use it to buy gold and silver. He seems to be under the impression that the. Since many IRA custodians that offer Self-Directed IRAs or Solo (k) plans allow you to invest in Gold, it is fairly easy to use your retirement funds to. A Gold IRA is an account opened specifically for investment in precious metals, like gold or silver. It differentiates itself from other retirement accounts. To invest retirement funds directly in physical gold and silver, a self-directed IRA is necessary. This allows you to buy eligible gold and silver coins and. Physical gold comes in the form of gold bullion (bars of gold), gold coins, or gold jewelry. Buying gold bullion is a direct investment in gold's value. He's decided that he wants to take out 2/3 of what is in his k, ~$k, and use it to buy gold and silver. He seems to be under the impression that the. To make the conversion, you will need to open a self-directed IRA. This type of account allows you to invest in assets such as gold and other. Can you buy gold with a k? · Q: Can you transfer an existing IRA into physical gold? · A: You sure can! In fact, most precious metal retirement plans start. Gold is not necessarily better than a k for retirement investing. Gold's price can be volatile and unpredictable, making it a risky choice. When you open a Gold & Silver IRA, you can reduce your taxable income by the amount you invest each year and you won't pay taxes on any of your gold profits. Yes you can buy gold with the money in a (k) but you will need to roll the funds over to an IRA that is capable of holding physical gold first. The rollover process can allow you to move your (k) into gold tax-free and penalty-free. A gold IRA is a type of self-directed IRA, an IRA that allows you to.

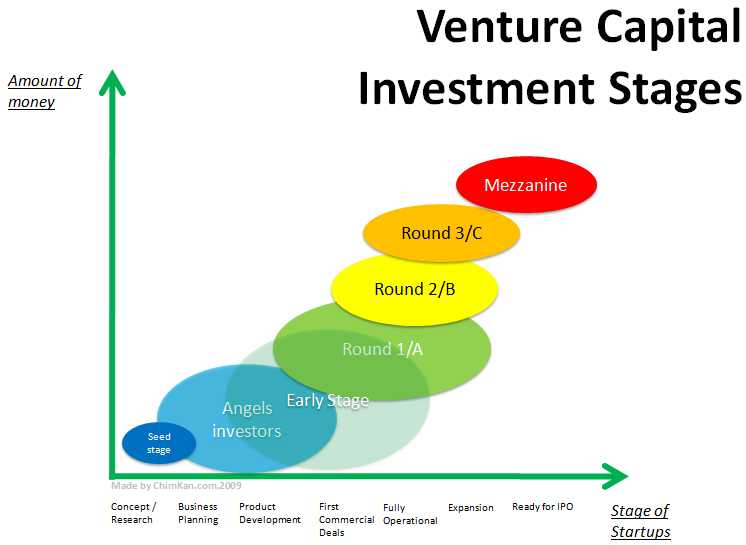

What Is A Series B Investment

While a Series A funding round is to really get the team and product developed, a Series B Funding round is all about taking the business to the next level. Series B funding · Dominate the market, fend off the competition, and establish itself as a category leader · Expand globally, enter new markets, and reach new. Series B financing (also known as series B round or series B funding) is one of the stages in the capital-raising process of a startup. A funding round is any time you raise money from one or more investors. They are labeled A, B, C, etc. because they happen in a series. Series B financing is the second round of investment financing for a company, including private equity investors and VCs. · The Series B round usually takes. This article will provide a comprehensive guide to everything about Series B funding, from what it is, to when you should consider it, to how to successfully. It's generally the first or second round of funding for a startup, depending on whether the founder went through a seed round or if the business was self-funded. Series A, B, and C funding is reserved for small businesses with outstanding growth potential or snowballing businesses and are ready to continue expanding. Your Series B marks the transition from early-stage startup toward growth stage. This is the money you'll use to pour fuel on the fire of your high-growth. While a Series A funding round is to really get the team and product developed, a Series B Funding round is all about taking the business to the next level. Series B funding · Dominate the market, fend off the competition, and establish itself as a category leader · Expand globally, enter new markets, and reach new. Series B financing (also known as series B round or series B funding) is one of the stages in the capital-raising process of a startup. A funding round is any time you raise money from one or more investors. They are labeled A, B, C, etc. because they happen in a series. Series B financing is the second round of investment financing for a company, including private equity investors and VCs. · The Series B round usually takes. This article will provide a comprehensive guide to everything about Series B funding, from what it is, to when you should consider it, to how to successfully. It's generally the first or second round of funding for a startup, depending on whether the founder went through a seed round or if the business was self-funded. Series A, B, and C funding is reserved for small businesses with outstanding growth potential or snowballing businesses and are ready to continue expanding. Your Series B marks the transition from early-stage startup toward growth stage. This is the money you'll use to pour fuel on the fire of your high-growth.

In a Series B funding round, the investment is typically led by venture capital firms and may include participation from existing investors. While Series B funding round has lower investment risks, the capital raised is also larger than Series A. You have a product that is already in the market. It can be hard for owners to prove to investors that they deserve their investment. In Seed and Series A rounds, investors invest in a dream (with a little bit. Series B funding is usually given to businesses with a high potential for growth, profit, and a healthy return on any investment. It follows series A funding. A Series B round is usually between $7 million and $10 million. Companies can expect a valuation between $30 million and $60 million. Series B funding usually. Series B funding comes after series A funding and is the second round of funding that a company receives. Series B funding is typically equal to. A Series B funding round is the third step in startup funding, following seed funding and Series A funding. Typically most startups which progress to this stage. In Series B investors provide capital to a company in exchange for the latter's preferred shares. The majority of the deals include anti-dilution provisions. The money raised during a Series B funding round is usually between $15 million and $50 million. What is Series C funding? Is there a Series D round? This stage of funding is all about scaling the business. Securing Series B funding will catalyze the next level of growth and tee a company up for later. Series B funding is the second round of funding for a company, and it is provided by investors such as private equity firms and venture capital firms. In series A, a startup is positioned to develop and refine its offer and processes. During series B, the cash is needed to be able to scale up and reach a much. Series B is typically $mil, but I am not exactly sure what is the difference between a "series" funding versus someone just investing a bit of cash in the. Investors The round was led by Moderne Ventures, bringing The Rounds' total funding to $66 million. Moderne Ventures is a strategic Continue reading · Opkey. A venture round is a type of funding round used for venture capital financing, by which startup companies obtain investment, generally from venture. A series B investment is typically made when a startup company has launched its product commercially and is starting to generate revenue. The. The name refers to the class of preferred stock sold to investors in exchange for their investment. It is usually the first series of stock after the common. Founders seek Series B Funding once their startup has an established performance record (e.g.,stable growth and/or revenue) and they aim to. This whitepaper showcases average team sizes for payments companies as they go through different funding rounds. Series B funding is focused on propelling the startup to the next level, while Series C funding is concerned with scaling the business even more rapidly. It is.

Real Shiba Inu Coin

View live Shiba Inu chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. Create real-time notifications and alerts Search for SHIB on the exchange or broker and input the amount of Shiba Inu coin you want to buy. The price of Shiba Inu (SHIB) is $e-5 today, as of Sep 05 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. Shiba Inu originally was designed as a digital currency. It has since launched a decentralized crypto exchange in an attempt to build the Shiba Inu ecosystem. shib on SHIBASWAP. arrow-right · View shib on Coingecko. arrow-right. tokenPic. BONE TOKEN. BONE, our ecosystem's governance token, has a million supply. It. Will Shiba Inu coin price reach 1 dollar? Can Shiba coin reach $10? Is Shiba Inu coin real? Does Shiba Inu coin have a future? Is Shiba Inu a good investment? Real physical gold plated Shiba Inu coin[ edition], collectable commemorative crypto coin with protective case and show box, gift for Shiba Lover. The live Shiba Inu price today is $ with a hour trading volume of $M. The table above accurately updates our SHIB price in real time. The. The live price of Shiba Inu is $ per (SHIB / USD) with a current market cap of $ B USD. hour trading volume is $ M USD. SHIB to USD price. View live Shiba Inu chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. Create real-time notifications and alerts Search for SHIB on the exchange or broker and input the amount of Shiba Inu coin you want to buy. The price of Shiba Inu (SHIB) is $e-5 today, as of Sep 05 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. Shiba Inu originally was designed as a digital currency. It has since launched a decentralized crypto exchange in an attempt to build the Shiba Inu ecosystem. shib on SHIBASWAP. arrow-right · View shib on Coingecko. arrow-right. tokenPic. BONE TOKEN. BONE, our ecosystem's governance token, has a million supply. It. Will Shiba Inu coin price reach 1 dollar? Can Shiba coin reach $10? Is Shiba Inu coin real? Does Shiba Inu coin have a future? Is Shiba Inu a good investment? Real physical gold plated Shiba Inu coin[ edition], collectable commemorative crypto coin with protective case and show box, gift for Shiba Lover. The live Shiba Inu price today is $ with a hour trading volume of $M. The table above accurately updates our SHIB price in real time. The. The live price of Shiba Inu is $ per (SHIB / USD) with a current market cap of $ B USD. hour trading volume is $ M USD. SHIB to USD price.

This is due to several factors, but the main ingredient to their success is the backing of a strong community rather than real-world utility. For instance, Elon. Instantly check what is Shiba Inu price today. See SHIB price live charts & crypto market cap based on real blockchain data. Learn all SHIB coin metrics. The interesting part about that is Dogecoin was released in as nothing more than a joke. It's a meme-coin that we all acknowledge has no real-world value. Shiba Inu coins first entered circulation in through a decentralized exchange offering on Uniswap at an initial Shib price of $ According to. Shiba Inu's price today is US$, with a hour trading volume of $ M. SHIB is % in the last 24 hours. It is currently % from its 7-day. Dogecoin, Memecoins, and Shiba Inu Given the above-cited initiatives in development, it's evident that the Shiba Inu crypto project has real aspirations. Although Shiba Inu coin operates on the current Ethereum network that uses Proof-of-Work (PoW), it cannot be mined directly. At its launch, over one quadrillion. The current Shiba Inu price is $ In the last 24 hours Shiba Inu price moved %. The current SHIB to USD conversion rate is $ per SHIB. The future of Shiba Inu, as a meme coin cryptocurrency, remains uncertain and highly speculative. Get access to real-time market data, historical prices, and. In a bid to see if Shiba Inu has true value and support behind it How Many Shiba Inu (SHIB) Coins Are in Circulation? Shiba Inu states on its. Track the latest Shiba Inu price, market cap, trading volume, news and more with CoinGecko's live SHIB price chart and popular. Buy Cryptochips | Shiba Inu (SHIB) Physical Crypto Coin | Commemorative Cryptocurrency You Can HODL: Novelty & Gag Toys - lada-56.ru ✓ FREE DELIVERY. The Shiba Inu price is $ Find SHIB trends, real-time charts & price People who own Shiba Inu also own. DOGE Dogecoin · ADA Cardano · BTC Bitcoin. CoinGecko provides a fundamental analysis of the crypto market. In addition to tracking price, volume and market capitalisation, CoinGecko tracks community. Shiba Inu is an Ethereum-based altcoin that features the Shiba Inu hunting dog as its mascot and is considered an alternative to Dogecoin by its community. Track current Shiba Inu prices in real-time with historical SHIB USD charts, liquidity, and volume. Get top exchanges, markets, and more. While Shiba Inu started as a meme coin, efforts have been made to increase its real-world usability. This includes being accepted by some online retailers and. Like Dogecoin (DOGE %), it's based on the Doge meme, which features a Shiba Inu dog. It even calls itself the "Dogecoin killer." The white paper (referred. SHIB TOKEN. Shiba Inu (SHIB) is our key token, embodying a global, decentralized, community-driven currency. Launched in , this Ethereum-based token is a. Shiba Inu (SHIB) is a token that aspires to be an Ethereum-based alternative to Dogecoin (DOGE), the popular memecoin. Unlike Bitcoin, which is designed to be.

Next Big Robinhood Stock

Most penny stocks are traded on major stock exchanges. Here is a list of the best robinhood penny stocks to buy right now! Robinhood halts trading amidst global market meltdown · Investor's Business Daily. 6 days ago. These Are The Best Robinhood Stocks To Buy Or Watch Now. My top 3 Robinhood penny stocks to buy now (as long as their price action is strong) are Serve Robotics Inc (NASDAQ: SERV), Mira Pharmaceuticals Inc (NASDAQ. Unlock Your Financial Future with Robinhood: Curious about stocks, cryptocurrencies, or options? If you're looking to talk with others about your next big. View the real-time HOOD price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Unlock Your Financial Future with Robinhood: Curious about stocks, cryptocurrencies, or options? If you're looking to talk with others about your next big. View the real-time BIG price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Robinhood Markets Inc HOOD:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/17/24 · 52 Week Low · 8 Robinhood Penny Stocks To Watch Stock Ticker Company Performance (YTD) NASDAQ: NNOX Nano-X Imaging Ltd + % NASDAQ: CXAI CXApp Inc +. Most penny stocks are traded on major stock exchanges. Here is a list of the best robinhood penny stocks to buy right now! Robinhood halts trading amidst global market meltdown · Investor's Business Daily. 6 days ago. These Are The Best Robinhood Stocks To Buy Or Watch Now. My top 3 Robinhood penny stocks to buy now (as long as their price action is strong) are Serve Robotics Inc (NASDAQ: SERV), Mira Pharmaceuticals Inc (NASDAQ. Unlock Your Financial Future with Robinhood: Curious about stocks, cryptocurrencies, or options? If you're looking to talk with others about your next big. View the real-time HOOD price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Unlock Your Financial Future with Robinhood: Curious about stocks, cryptocurrencies, or options? If you're looking to talk with others about your next big. View the real-time BIG price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Robinhood Markets Inc HOOD:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/17/24 · 52 Week Low · 8 Robinhood Penny Stocks To Watch Stock Ticker Company Performance (YTD) NASDAQ: NNOX Nano-X Imaging Ltd + % NASDAQ: CXAI CXApp Inc +.

Market Data · Canada · Asia · Latin America · Investing · Barron's · Best New Ideas · Stocks · IPOs · Mutual Funds · ETFs · Options · Bonds · Commodities. MAGS began trading on April 11, as the Roundhill BIG Tech ETF. The Robinhood. Fidelity. E-Trade. Webull. SoFi. lada-56.ru Interactive Brokers. My top 3 Robinhood penny stocks to buy now (as long as their price action is strong) are Serve Robotics Inc (NASDAQ: SERV), Safety Shot Inc (NASDAQ: SHOT), and. Next. RobinHood Penny Stocks - Find stocks under $5 on RH. Penny stocks available to trade in the RobinHood mobile stock trading app. Browse top penny stock. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission fees. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Robinhood backlash: What you should know about the GameStop stock controversy big questions about Robinhood, the actions it took and what might happen next. Stocks, Options, ETFs / Crypto · Robinhood Markets, Inc. · iPhone Screenshots · Additional Screenshots · Description · What's New · Ratings and Reviews · App Privacy. Robinhood will provide new users with a default stock watchlist so you can Best Stock & Investing Newsletters · Best Stocks to Buy Now · Beginners. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. During regular market hours ( AM Robinhood Stocks That Will Blow Up: [5] Upstart Holdings [4] SoFi Moreover, Upstart has a huge addressable market into which it can expand. Its. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood traders had little daily impact on major shares. In May "New Robinhood app offers free trading. Millennials jump in". CNNMoney. Most penny stocks are traded on major stock exchanges. Here is a list of the best robinhood penny stocks to buy right now! stock index of large-cap stocks. The fund is definitely one of the earlier Is the fund buying pharma companies because they're making the next blockbuster. Sign up for Robinhood and get stock on us. Sign up for Robinhood. Certain limitations apply. New customers need to sign up, get approved. This is my lazy, but practical approach to passively investing in the stock market for free. I'll provide insight into how I used Robinhood. Robinhood is providing new users with up to $1, in free stock in the first year, along with ongoing opportunities to earn up to $1, annually through. Stocks & Retirement: Robinhood Financial Crypto trading: Robinhood Crypto Spending/Debit: Robinhood Money Credit Card: Robinhood Credit Support. Robinhood, 85 Willow Road, Menlo Park, CA © Robinhood. All rights reserved. What We Offer. Invest · Crypto.

How To Caculate Intrest

How to Calculate Interest rate? · Formula: Simple Interest (SI) = Principal (P) x Rate (R) x Time (T) / · Example: If you invest Rs1, with a 5% annual. How do you Calculate Interest on a Revolving Line of Credit? · Determine the interest rate · Current Balance · Multiply Balance by Interest Rate · Multiply by. In order to calculate the monthly interest charges to your balance you simply need to multiply this daily periodic rate by the number of days in your billing. You can use the calculator below to calculate interest payments. The Gatehouse Chambers online calculators are provided for you to use free of charge, and on an. To start, you'd multiply your principal by your annual interest rate, or $10, × = $ Then, you'd multiply this value by the number of years on the. The formula for calculating simple interest is I = P x R x T, where I is the amount of interest, P is the principal balance or the average daily balance, R is. You calculate the simple interest by multiplying the principal amount by the number of periods and the interest rate. Simple interest does not compound, and you. To calculate the interest due on your loan, please follow the steps below: 1. Obtain the new principal balance of your loan from your Online Banking Account. To calculate interest without a calculator, use the formula A=P(1+r/n)^nt, where: A = ending amount. P = original balance. r = interest rate (as a decimal). n. How to Calculate Interest rate? · Formula: Simple Interest (SI) = Principal (P) x Rate (R) x Time (T) / · Example: If you invest Rs1, with a 5% annual. How do you Calculate Interest on a Revolving Line of Credit? · Determine the interest rate · Current Balance · Multiply Balance by Interest Rate · Multiply by. In order to calculate the monthly interest charges to your balance you simply need to multiply this daily periodic rate by the number of days in your billing. You can use the calculator below to calculate interest payments. The Gatehouse Chambers online calculators are provided for you to use free of charge, and on an. To start, you'd multiply your principal by your annual interest rate, or $10, × = $ Then, you'd multiply this value by the number of years on the. The formula for calculating simple interest is I = P x R x T, where I is the amount of interest, P is the principal balance or the average daily balance, R is. You calculate the simple interest by multiplying the principal amount by the number of periods and the interest rate. Simple interest does not compound, and you. To calculate the interest due on your loan, please follow the steps below: 1. Obtain the new principal balance of your loan from your Online Banking Account. To calculate interest without a calculator, use the formula A=P(1+r/n)^nt, where: A = ending amount. P = original balance. r = interest rate (as a decimal). n.

(# of days late / ) x (applicable prompt payment interest rate) x (amount of payment) = (interest due). So his SI will be calculated as Rs. ( X 5 X 2/) which is equal to Rs What is the Simple Interest Formula and when is it Used? The amount one. While this tool focuses on the calculation of interest rates once the rates have been set, it is important to note here that officials should exercise caution. To calculate your monthly interest rate, divide the annual interest rate by For instance, if your annual rate is 5%, your monthly rate is approximately The formula to calculate compound interest is to add 1 to the interest rate in decimal form, raise this sum to the total number of compound periods, and. Free compound interest calculator to find the interest, final balance, and schedule using either a fixed initial investment and/or periodic contributions. How to Calculate Auto Loan Interest: First Payment Only · Divide your interest rate by the number of monthly payments per year. · Multiply the monthly payment. To calculate simple interest on a loan, multiply the principal amount P by the interest rate R and the time t (in years) using the formula I=P*R*t. As the name suggests, this can lead to relatively simple calculations for interest expenses. For example, to calculate the simple interest expense of a $5, Interest on a loan, such as a car, personal or home loan, is usually calculated daily based on the unpaid balance. This typically involves multiplying your loan. Your daily interest rate is different from your annual percentage rate. Learn more about what your daily periodic rate is and how to calculate it yourself. How Interest Is Calculated. Debtors are allowed a day grace period Principal x Interest rate ÷ 12 = monthly interest x # Interest periods = Total Interest. Simple interest formula. Here is the mathematical formula, on which a simple interest calculator works to compute the loan amount: · A = P (1+RT). To calculate. The formula to calculate simple interest is made up of multiplying three factors: principal amount, rate, and time. The principal is the original amount of. Your daily interest rate is different from your annual percentage rate. Learn more about what your daily periodic rate is and how to calculate it yourself. Simple interest is calculated by multiplying the loan principal by the interest rate and then by the term of a loan. Compound interest multiplies savings or. How to calculate credit card interest · Locate your balance, current APR and number of days in your billing cycle on your credit card statement. · Divide your APR. Simple interest is a method to calculate the amount of interest charged on a sum at a given rate and for a given period of time. In simple interest, the. Simple interest is calculated on the original principal amount every time, Compound interest is calculated on the accumulated sum of principal and interest. If the loan you are quoted has a duration of one year or more, simple interest is calculated as follows: Interest paid = Principal x Annual Interest Rate x Term.

Co Lending Agreement

The Person in whose name a Note Holder is so registered shall be deemed and treated as the sole owner and holder thereof for all purposes of this Agreement. Policy governing CLM arrangement: a). Master Agreement shall cover the following areas: Policies/processes and systems in place for NBFC (including HFC). THIS CO-LENDER AGREEMENT (this “Agreement”) is dated as of November 6, , between Column Financial, Inc. (“COLUMN”, in its capacity as initial owner of. Get the Official Word Add-in Co-Lending Agreement. (1). The Co-Lending Agreement sets forth certain rights and responsibilities of Administrative Agent and. 01/ dated September 21, issued guidelines on co-origination of loans by banks and NBFCs for lending to priority sector. The arrangement entailed. A Master Agreement is to be entered between the Bank and NBFC, which shall inter-alia include, terms and conditions of the arrangement, the criteria for. Both lenders decide and agree to lend to the ultimate borrower together, in accordance with the co-lending agreement executed between both lenders. The. MCPP investor approval is generally sought at mandate stage, thereby offering certainty of co-investor financing much earlier than in traditional syndications. In terms of the CLM (Co- Lending Model), RBL Bank can enter into Co-Lending arrangement with all eligible partners as defined by RBI, based on a prior agreement. The Person in whose name a Note Holder is so registered shall be deemed and treated as the sole owner and holder thereof for all purposes of this Agreement. Policy governing CLM arrangement: a). Master Agreement shall cover the following areas: Policies/processes and systems in place for NBFC (including HFC). THIS CO-LENDER AGREEMENT (this “Agreement”) is dated as of November 6, , between Column Financial, Inc. (“COLUMN”, in its capacity as initial owner of. Get the Official Word Add-in Co-Lending Agreement. (1). The Co-Lending Agreement sets forth certain rights and responsibilities of Administrative Agent and. 01/ dated September 21, issued guidelines on co-origination of loans by banks and NBFCs for lending to priority sector. The arrangement entailed. A Master Agreement is to be entered between the Bank and NBFC, which shall inter-alia include, terms and conditions of the arrangement, the criteria for. Both lenders decide and agree to lend to the ultimate borrower together, in accordance with the co-lending agreement executed between both lenders. The. MCPP investor approval is generally sought at mandate stage, thereby offering certainty of co-investor financing much earlier than in traditional syndications. In terms of the CLM (Co- Lending Model), RBL Bank can enter into Co-Lending arrangement with all eligible partners as defined by RBI, based on a prior agreement.

This policy, for entering a Co-. Lending arrangement with the banks, has been formulated in line with the RBI guidelines. 2. Objectives. Sundaram Finance. The Bank may engage with NBFCs registered with RBI for Co-Lending. The arrangement should entail joint contribution of credit at the facility level, by both. The arrangements meant joint contribution of credit facility by both bank and NBFC lenders and sharing both risks and rewards. This arrangement was made keeping. SHFL may enter into Co-Lending arrangement with any of the Banks, Financial Institution or SME Lenders which are eligible to engage in the business of Co-. This CLM policy covers terms and conditions of the partnership, the criteria for selection of partner institutions, the specific product lines, and areas of. A Master Agreement is to be entered between the Bank and NBFC, which shall inter-alia include, terms and conditions of the arrangement, the criteria for. The Master Agreement entered by the Bank and Co-Lending partners for implementing the CLM should provide either for the Bank to mandatorily take their share of. Should make profit for last 3 financial years. XIV. Co-lending arrangement with an NBFC belonging to the promoter Group shall not be allowed. XV. NBFCs should. Under the Co-lending arrangement, bank is permitted to co-lend with all registered NBFCs. (including HFCs) based on a prior agreement. A loan will be partially. Co-lending refers to a lending arrangement where two lenders collaborate to meet the requirements of a loan application. Specifically, co-lending occurs when a. co-lending is a mix of limited purpose partnering in lending business. (governed by intercreditor agreement), a lending arrangement between the co-lenders. The said Master Agreement may provide for the bank to either (a) mandatorily take its share of the individual loans as originated by the NBFC in their books (". Policy on Co-lending Model (CLM) with NBFCs/HFCs for PSL · 2. Selection of product · 3. Credit screening parameters and Master agreement · 4. Sanction amount/. In terms of Co-lending guidelines, bank have two options under the co-lending mechanism between the Co-lenders may be mutually decided basis mutual agreement. The arrangement would entail a joint contribution of credit at the facility level, by both the Company and the Lenders. The co-lending parties shall maintain. As per the revised Co-Lending Model (CLM), banks are permitted to co-lend with all registered NBFCs (including HFCs) based on a prior agreement. Scope and Modus. The Master Agreement may provide for the banks to either mandatorily take their share of the individual loans originated by the NBFCs in their books as per the. Based on the CLM policy, banks may enter into master agreement with the eligible NBFC, including terms and conditions of the arrangement, criteria for selection. RBI has asked Banks to formulate a Board approved policy for entering into a co- lending agreement with the NBFCs/HFCs and place the approved policies on their.

2 3 4 5 6 7 8